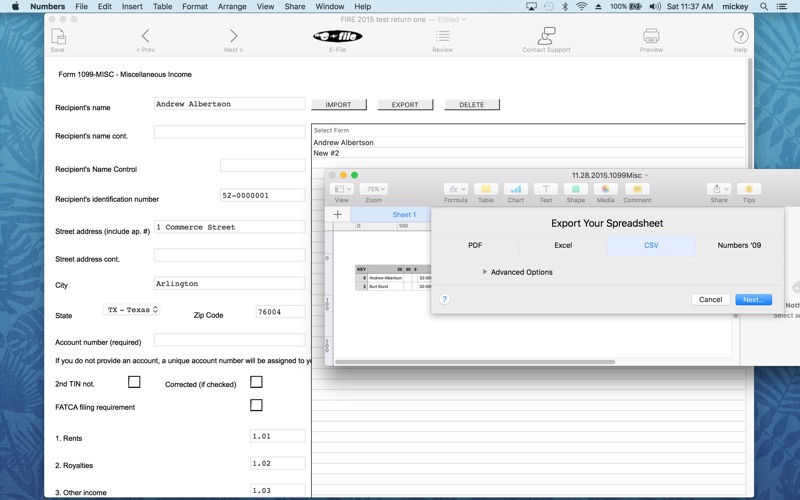

This is an easy, simple, quick, and accurate app from Taxsoftware.com. Enter your information directly on your Mac app, or use our IMPORT feature to import your data from a spreadsheet template. You can also EXPORT your data to a spreadsheet to edit or save it for next year.

When you file electronically, you are exempt from using pre-printed forms. You can just print the return in regular paper or email a PDF file to all recipients. We take care of the IRS copy.

And you can now order full service printing and mailing of your recipients copies from Taxsoftware.com. To order full printing and mailing, just make sure to check the box and we will take care of everything for you.

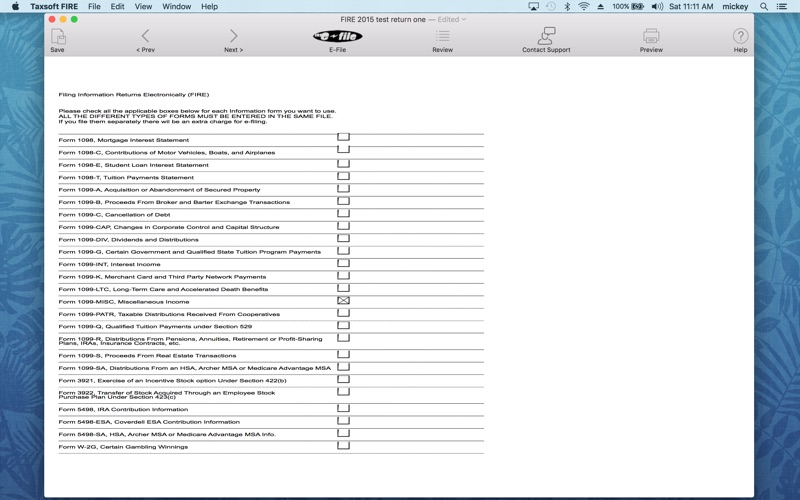

We offer most Information Return Forms (FIRE) and also Affordable Care Act Forms (ACA).

IRS Information Returns (FIRE) that we Offer for Tax Year 2015:

1042-s Foreign Persons U.S. Source Income Subject to Withholding

1098 Mortgage Interest Statement

1098-c Contributions of Motor Vehicles, Boats and Airplanes

1098-e Student Loan Interest Statement

1098-t Tuition Payments Statement

1099-a Acquisition or Abandonment of Secured Property

1099-b Proceeds from Broker and Barter Exchange Transactions

1099-c Cancellation of Debt

1099-cap Changes in Corporate Control and Capital Structure

1099-div Dividends and Distributions

1099-g Certain Government and Qualified State Tuition Program Payments

1099-h Health Coverage Tax Credit (HCTC) Advance Payments

1099-int Interest Income

1099-K Merchant Card and Third Party Network Payments

1099-ltc Long-Term Care and Accelerated Death Benefits

1099-misc Miscellaneous Income

1099-patr Taxable Distributions Received from Cooperatives

1099-q Qualified Tuition Program Payments (Under Section 529)

1099-r Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

1099-s Proceeds

1099-sa Distributions From an HSA, Archer MSA or Medicare + Choice MSA

3921 Exercise of an Incentive Stock option under Section 422(b)

3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan under Section 423(c)

5498 IRA Contribution Information

5498-esa Coverdell ESA Contribution Information

5498-sa HSA, Archer MSA or Medicare + Choice MSA Information

8027 Employers Annual Information Return of Tip Income and Allocated Tips

W2-g Certain Gambling Winnings

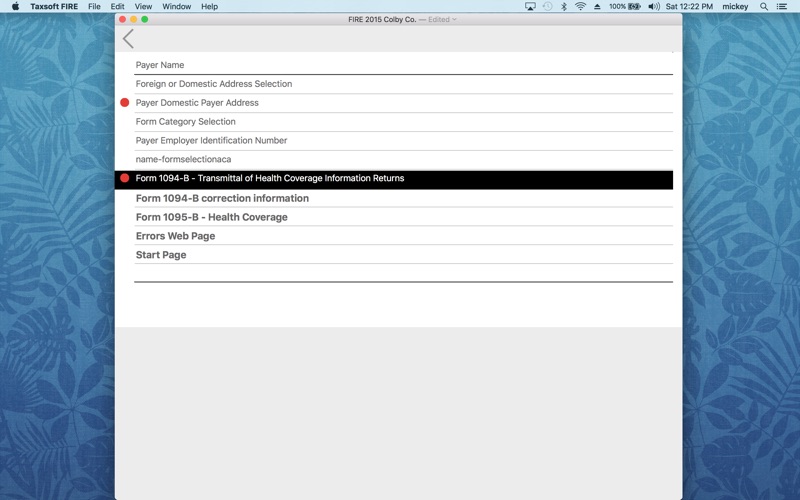

New Affordable Care Act (ACA) Form that we offer for tax year 2015:

1094-b (ACA) Transmittal of Health Coverage Information Returns

1094-c (ACA) Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

1095-b (ACA) Health Coverage

1095-c (ACA) Employer-Provided Health Insurance Offer and Coverage